r&d tax credit calculation example uk

To calculate your expenditure you need to. Work out the costs that were directly attributable to RD.

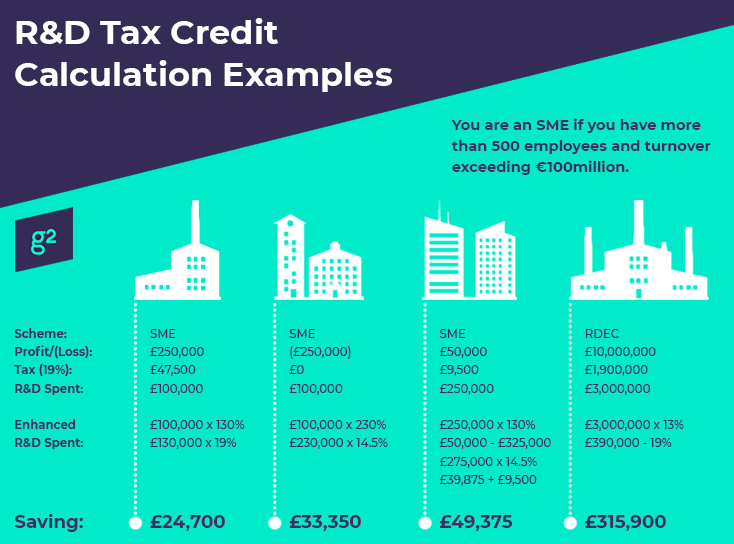

SME Scheme calculation for a company that was loss-making and spent 100000 on qualifying RD activities in a given year.

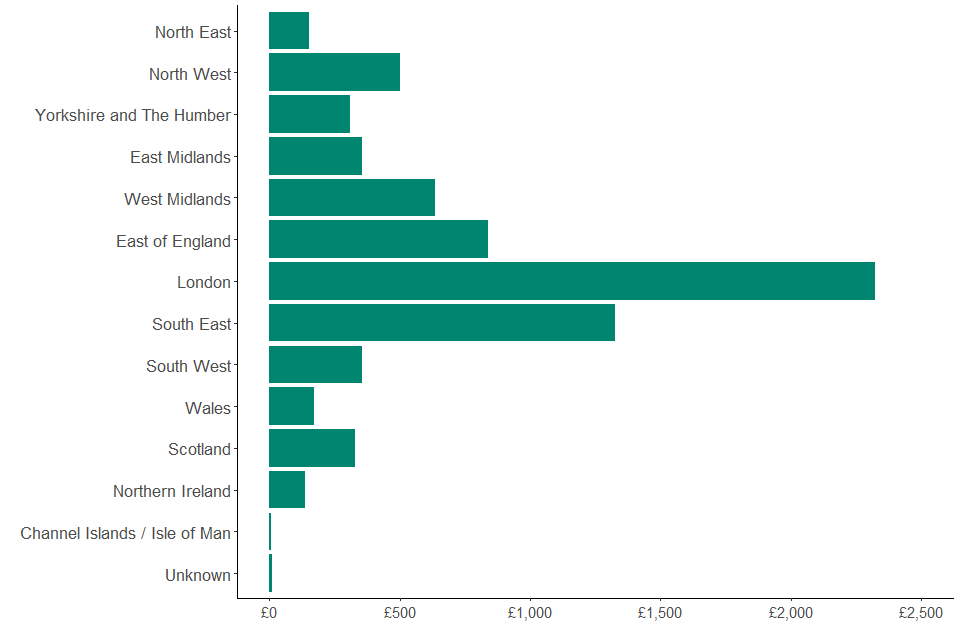

. Reduce any relevant subcontractor or external staff provider payments to. Corporation Tax CT before RD tax credit claim is 76000 Enhanced RD qualifying spend or uplift. For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid in.

100000 130 130000 The revised profit. So our simplified example tax computation would show. The notional additional 130 rd tax deduction is deducted within the company tax computation.

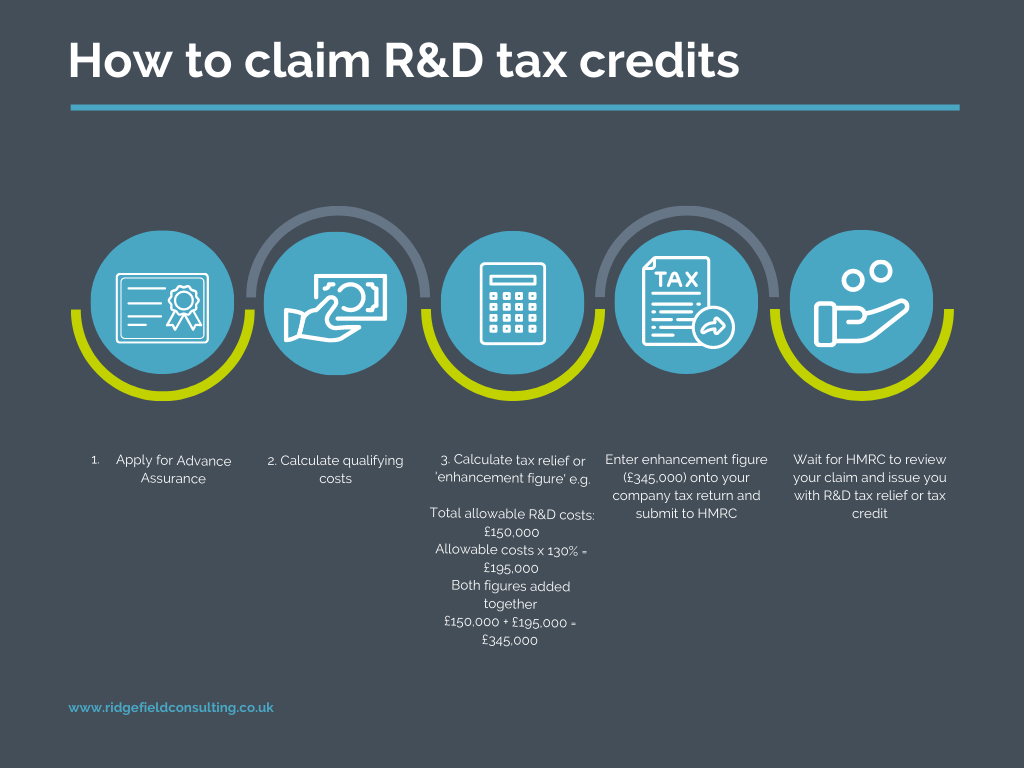

Deduct an extra 130 of their qualifying costs from their yearly profit as well as the normal 100 deduction to make a total 230. Just follow the simple steps below. Select either an SME or Large.

SME RD relief allows companies to. Get a detailed RD calculations to your. Calculate RD tax relief in under 3 minutes.

This tech startup was founded to make luxury social experiences more accessible via crowd sharing. Before RD tax additional deduction. If there is a 100000 payment to a subcontractor of which half is for RD activities the calculation would be 100000 x 50 50000 x 65 32500.

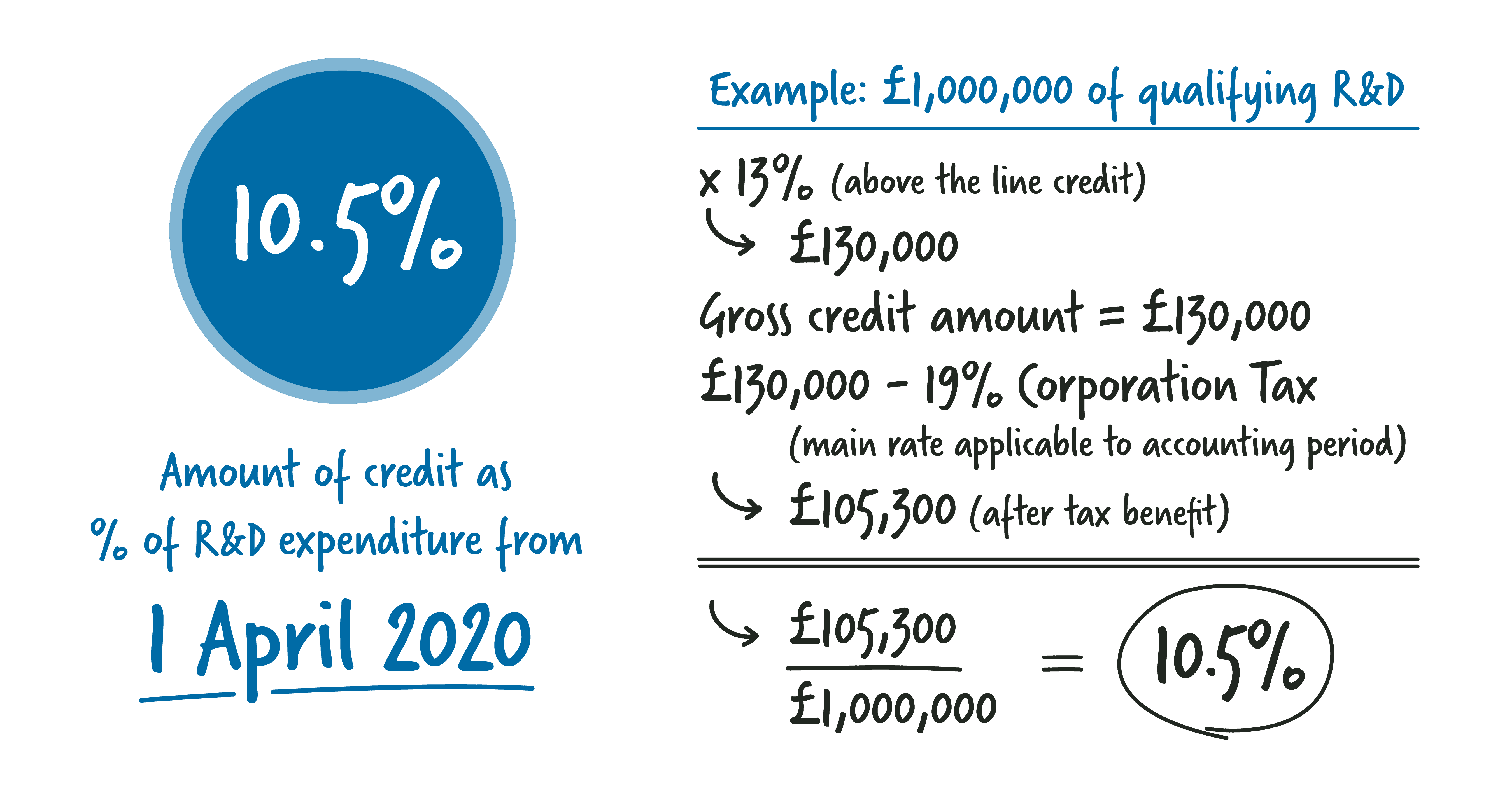

Taxable profit before RD. Its a social engagement. The credit is calculated at 13 of your companys qualifying rd expenditure.

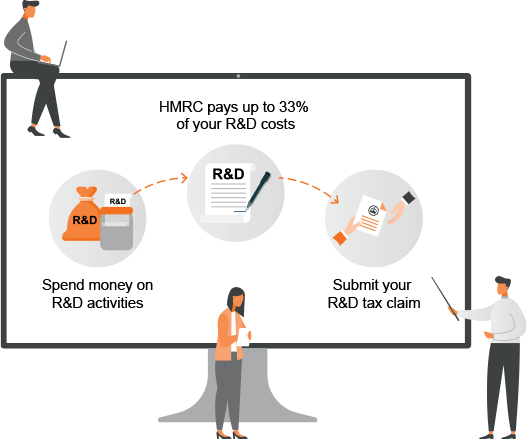

Supports Profit and Loss making companies. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. Second on our list of RD Tax Credit Examples is Dynamo.

250k less costs of 120k Tax payable. 400000 - 130000 270000. 100000 x 130 enhanced rate 130000 130000.

Estimate RD tax relief for your business. The RD Tax Relief for UK small and medium-sized enterprises SMEs has the same calculation for all companies applying to the program but your companies corporation tax has. Steps to calculate the RD tax credit via the traditional method 2 Total the QREs for the current tax year Determine aggregate QREs over a base period Divide the aggregate QREs by the.

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. This can be done for the current financial year and the 2 previous. 73150 pre-claim Corporation Tax 48450 post-relief Corporation Tax 24700 saving or refund Calculating RD tax credit for loss-making SMEs.

R D Tax Credit Calculation Adp

Sme R D Tax Credits Example Calculation How To Apply 230 Enhancement

What S The R D Tax Credit Program Overview Cti

R D Tax Credit And Deducting R D Expenditures Bloomberg Tax

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

.png)

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

How To Claim R D Tax Credits R D Accountants For Oxfordshire

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credits Calculation Examples G2 Innovation

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

R D Tax Credit Calculator Are You Getting The Full Benefit Of The R D Tax Credit

Research Development R D Tax Credits Faqs Bdo

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

R D Tax Credits Calculator Free To Use No Sign Up Counting King

R D Tax Credit Calculation Examples Mpa

What Is The R D Tax Credit And Could Your Company Qualify

R D Tax Credit Calculation Methods Adp